BOSTON - A new analysis reveals that the five key drivers of nature loss have the potential to cost eight sectors up to $430 billion per year, globally. This represents a cumulative loss of $2.15 trillion over the next five years if left unchecked, according to the report released today by the nonprofit sustainability organization Ceres.

These substantial findings from Nature's Price Tag: The economic cost of nature loss highlight the economic imperative of nature action by companies and their investors to avoid an escalating financial toll caused by damage to natural ecosystems. In fact, the report finds harming nature could cost individual sectors hundreds of billions of dollars each year, with the food sector facing the steepest annual price tag at $253 billion.

Of the primary contributors to nature loss, the report shows that climate impacts could cause the greatest economic toll to companies across sectors by degrading critical ecosystem services, which businesses depend on. This finding underscores the interconnected risks between climate and nature, and the need for companies and financial institutions to adopt integrated strategies that reflect the full scope of these linked risks.

Of the primary contributors to nature loss, the report shows that climate impacts could cause the greatest economic toll to companies across sectors by degrading critical ecosystem services, which businesses depend on. This finding underscores the interconnected risks between climate and nature, and the need for companies and financial institutions to adopt integrated strategies that reflect the full scope of these linked risks.

“By calculating the costs of inaction, our report shows for the first time the staggering financial risks of escalating nature loss to major sectors of the global economy,” said Meryl Richards, program director, food and forests at Ceres. “Ceres’ findings deliver companies and their investors a clear and compelling business case for addressing nature risk and building resilience now to prevent paying more for operational and supply chain disruptions, legal fees, and regulatory compliance later on.”

While estimates of the cost of nature loss exist, Ceres’ analysis is the first to quantify the financial costs of each key nature loss driver on the eight sectors individually. These sectors – biotechnology and pharmaceuticals, chemicals, consumer goods retail, food and beverage retail, food production, forestry and packaging, household and personal goods, and metals and mining – not only have significant impacts on nature but also depend on natural ecosystems to prosper.

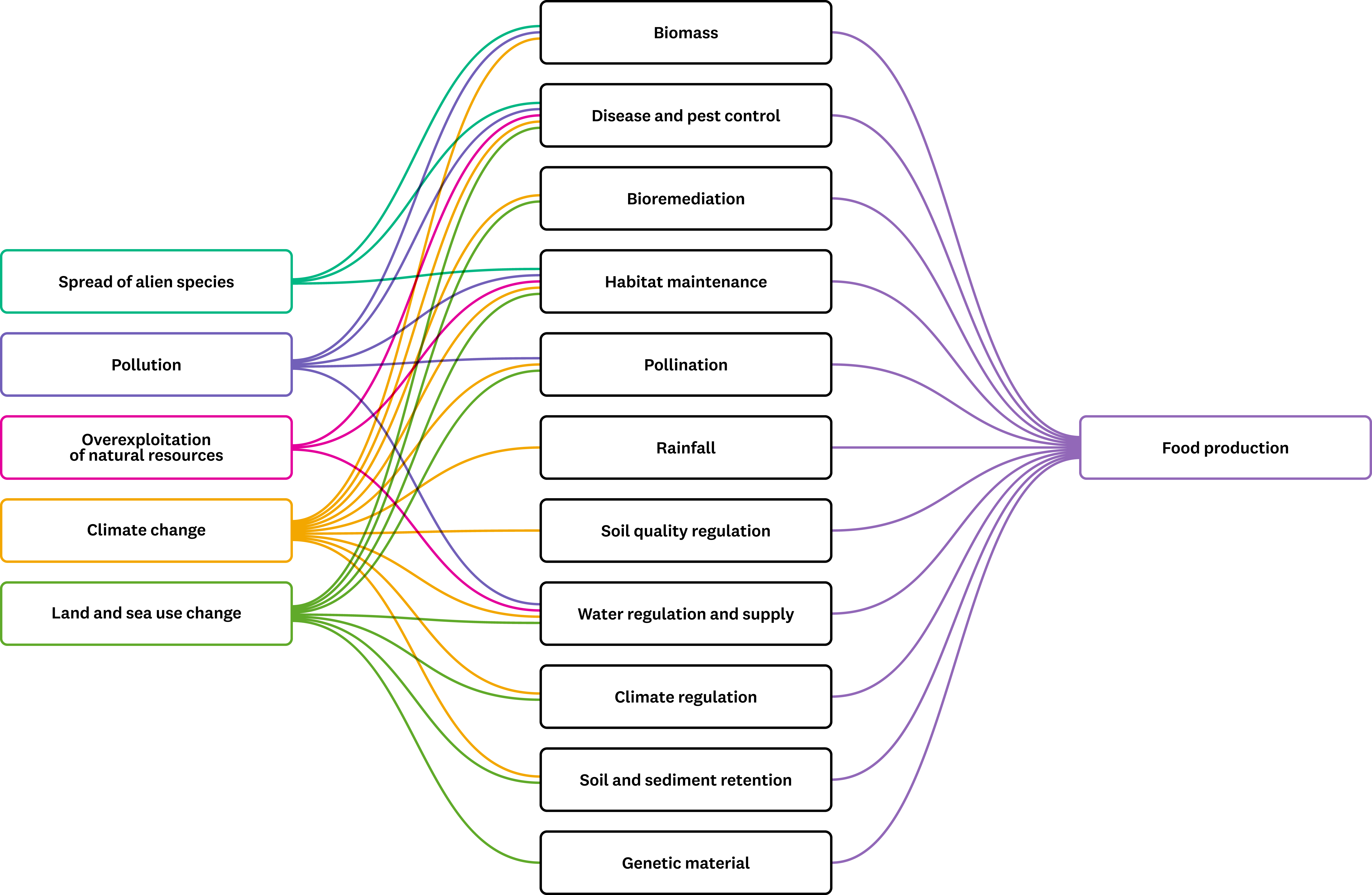

The financial toll to each of these sectors was calculated using sophisticated economic modeling to quantify the cost of nature loss by driver and ecosystem service, such as climate regulation, soil retention, and pest and disease control. Though the tolls are considerable, Ceres’ estimates are conservative, covering the costs of physical risks to direct business operations and not most supply chain risks. The actual price points are likely to be much more expensive once all those risks – from higher investment requirements to litigation fees – are factored in.

Along with analyzing the expected annual costs to sectors, Ceres calls out a notable example of how food companies are already having to account for a decline in pollination services, which alone are valued at nearly $25 billion per year. In 2024, U.S. farmers paid over $400 million dollars for hired pollination services – a price that will keep ratcheting up with further ecosystem degradation.

“As most companies and their investors are still early in their nature action journeys, we provide needed sectoral insight into how nature loss is eroding critical ecosystem services to support their action,” said Carolyn Ching, director of research, food and forests, at Ceres. “Our analysis builds on Ceres’ field guide to nature-related impacts and dependencies released in 2023 – which assessed the impacts and dependencies in the same eight sectors – to further help investors identify engagement priorities to mitigate nature financial risk across their portfolios and ensure long-term shareholder value.”

Through research and consultations with investors, Ceres developed an investor engagement framework organized around four areas of company action: assessing impacts and dependencies; making commitments and setting targets; transforming the value chain; and creating an enabling environment. For each area, the report lists indicators that investors can look for to assess corporate progress.

View Ceres’ report Nature's Price Tag: The economic cost of nature loss.

x

About Ceres

Ceres is a nonprofit advocacy organization working to accelerate the transition to a cleaner, more just, and sustainable world. United under a shared vision, our powerful networks of investors and companies are proving sustainability is the bottom line—changing markets and sectors from the inside out. For more information, visit ceres.org.